kern county tax collector payment center

Child Abuse or Neglect. Search for Recorded Documents or Maps.

Jordan Kaufman Kern County Treasurer Tax Collector Facebook

Kern County Property Records are real estate documents that contain information related to real property in Kern County California.

. If you inadvertently authorize duplicate transactions for any reason and those duplicate authorizations result in payments returned for insufficient or uncollected funds an additional 27 returned payment fee for each duplicate transaction will be charged. Learn about the 10 Recorder Anti-Fraud Fee attached to the recording of several real estate instruments. Secured tax bills are paid in two installments.

Join Courts Press Mailing List. The various payment methods available include mailing a check cash or money order to the KCTTC payment center PO. Kern County Treasurer-Tax Collector mails out original secured property tax bills in October every year.

Please type the text from the image. Box 541004 Los Angeles CA 90054-1004. The first installment is due on 1st November with a payment deadline on 10th December.

Here youll find many opportunities to learn Kern Countys story through digital content news releases community events and updates from our departments. Fraud Waste and Abuse in Kern County Government. The Kern County Treasurer-Tax Collectors Office located in Bakersfield California is responsible for financial transactions including issuing Kern County tax bills collecting personal and real property tax payments.

Crime Non-Emergency Domestic Violence. Credit cards and debit cards have a 2 card processing fee based on the amount of taxes paid. The 2 processing fee is the same whether you pay on-line or in person.

The County Treasurer-Tax Collectors office offers support and training to County departments and depositing agencies including guidelines and procedures for proper cash receipting. Do not include correspondence with your payment. 800 933-9808 Office hours.

Crime Non-Emergency Domestic Violence. If your tax bill is not available please provide your Assessor Tax Number or an adequate legal description along with your payment. Property Taxes - Pay Online.

Fraud Waste and Abuse in Kern County Government. Welcome to the Kern County online tax sale auction website. Of course exact tax rates vary based on.

File an Exemption or Exclusion. Box 541004 Los Angeles CA 90054-1004 or via the treasure-tax collectors. Correspondence must include the Assessor Tax Number.

The first round of property taxes is due by 5 pm. File an Assessment Appeal. Electronic Checks ACH can be used for on-line payments with zero fees.

Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents. They are maintained by various government offices. Request Refund of Court Reporter Fees.

In Kern County the average property tax rate is 08 making property taxes slightly higher than the state average. It is the responsibility of the County Treasurer-Tax Collectors office to resolve deposit problems with the Countys bank no matter what departmentagency. Property Taxes - Pay Online.

Kern County Business Recruitment Job Growth Incentive Initiative. 2 days ago1 Pay online. For all information regarding delinquent tax bills or a redemption from tax defaulted properties contact the County Treasurer-Tax Collector 1115 Truxtun Avenue 2nd Floor Bakersfield CA 93301-4639 661 868-3490 or use the 24 hour information system see item 4 below.

Child Abuse or Neglect. Learn about how to request a value review or file an assessment appeal without paying unnecessary fees to private companies. This convenient service uses the latest technology to provide a secure way to bid on tax defaulted property.

The Kern County treasurer and tax collector is warning people not to be. Property Taxes - Pay by Wire. Press enter or click to play code.

Address Phone Number and Fax Number for Kern County Treasurer-Tax Collectors Office a Treasurer Tax Collector Office at Truxtun Avenue Bakersfield CA. The offices of the Assessor-Recorder Treasurer-Tax Collector Auditor-Controller-County Clerk and the Clerk of the Board have prepared this property tax information site to provide tax payers with an overview of the property tax process in Kern County. Via the Treasurer-Tax Collectors website at wwwkcttccokerncaus Electronic Checks ACH can be used for on-line payments with zero fees.

This means that residents can expect to pay about 1746 annually in property taxes. DeedAuction is part of our offices. Purchase a Birth Death or Marriage Certificate.

Change a Mailing Address. Request a Value Review. Credit cards and debit cards have a 2 card processing fee based on the amount of taxes paid.

Crime Non-Emergency Domestic Violence. Property Taxes - Pay Online. Via the Treasurer-Tax Collectors website at wwwkcttccokerncaus.

With easy access to tax sale information and auction results you can research properties and enter bids from anywhere in the world. A 10 penalty is. Enter an 8 or 9 digit APN number with or without the dashes.

Property Taxes - Pay by Wire. Check out our new site for information about Kern County government. Tax payments only must be mailed to.

No Fee is Necessary to Request a Value Review or to File an Assessment Appeal. Get Information on Supplemental Assessments. The Kern County Treasurer-Tax Collector will present this ACH transaction to your bank for immediate payment.

Find Property Assessment Data Maps. The Kern County Treasurer and Tax Collectors Office is part of the Kern County Finance Department that encompasses all financial functions of the local government.

Kern County Under Investigation For Alleged Discrimination And Civil Rights Violations Kget 17

About The Grand Jury Kern County Ca

Events Kern County Taxpayers Association

About The Grand Jury Kern County Ca

Jordan Kaufman Kern County Treasurer Tax Collector Kern County Linkedin

Kern County Treasurer And Tax Collector

Jordan Kaufman Kern County Treasurer Tax Collector Facebook

![]()

Transportation Kern County Public Works

About The Grand Jury Kern County Ca

Jordan Kaufman Kern County Treasurer Tax Collector Facebook

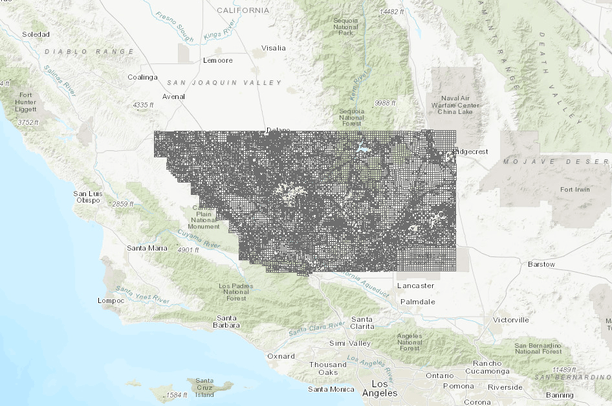

Parcels 2019 Kern County Data Basin

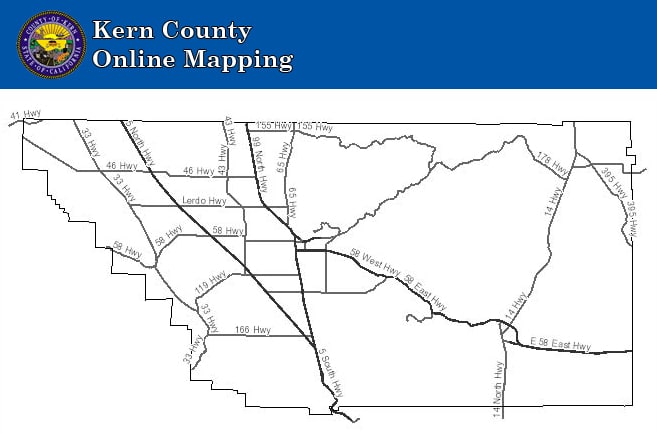

Interactive Maps Kern County Planning Natural Resources Dept

Water Association Of Kern County Home Facebook

Jordan Kaufman Kern County Treasurer Tax Collector Facebook

Kern County Treasurer And Tax Collector

Kern County Law Library Home Facebook